Rightmove’s latest House Price Index report outlines how the mass-market prices hit a new record. But with this comes the warning that the upper end of the market is showing signs of cooling.

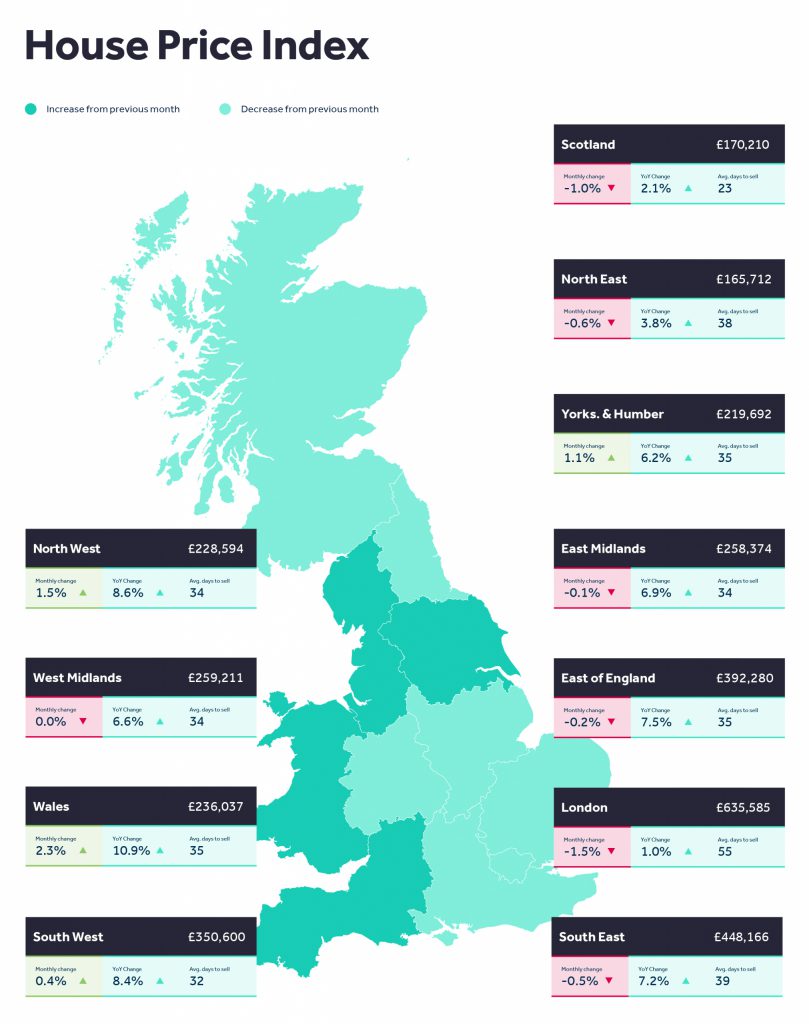

Wales stands out on this report as the part of the UK with the largest price growth in the last 12 months, where prices have increased by a staggering 10.9%, the highest of any other part of the UK. The average house price in Wales now stands at £236,037. This is still well below most sectors of the UK but does show that the Race for Space has impacted our house prices on this side of the bridge.

Covid-19 has changed the way we all look at our lives and, while working from home has its benefits, there is no doubt that having that extra room, or large garden to build your new home garden office, is now high on the list of priorities.

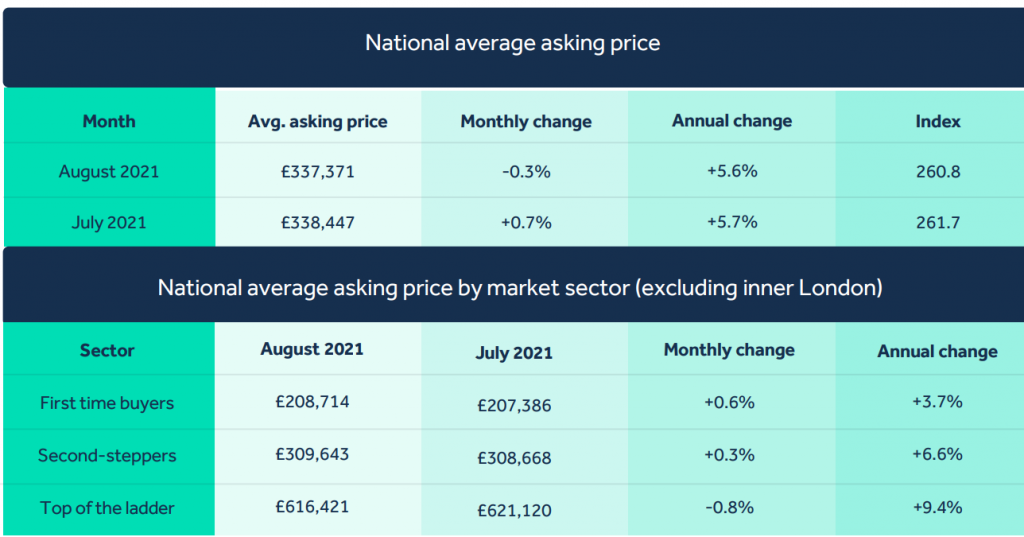

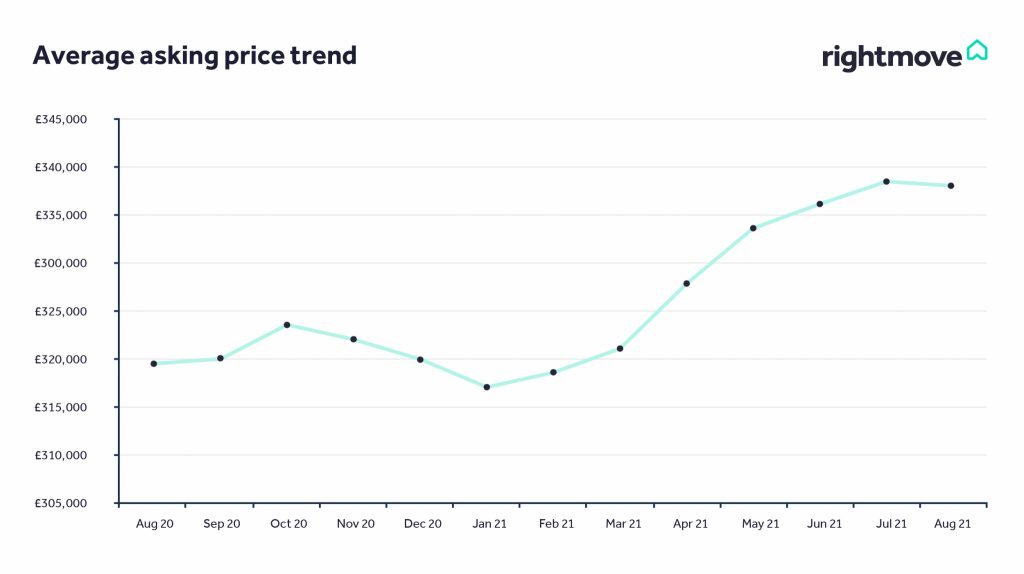

While this is good news, there is a warning in this message. According to the House Price Index report from Rightmove the average price of property coming to market has fallen this month by 0.3% (-£1,076), this was driven by a 0.8% drop in the upper-end typically four-bedroom-plus sector, showing that perhaps the end of the Land Transaction Tax holiday may be having some effect after all.

Tim Bannister, Rightmove’s Director of Property Data, comments: “New sellers dropping their asking prices can ring economy alarm bells, especially when it’s the first time so far this year, so it’s important to dig underneath the headline figures. Firstly, we are in the holiday season which means that sellers have traditionally tempted distracted buyers with lower prices, though that might well be less applicable this year with many buyers having to stay a lot closer to home. Indeed, our analysis shows that average prices have only fallen in the upper-end sector, which is usually more affected by seasonal factors such as the summer holidays and has also seen the greatest withdrawal of stamp duty incentives. The mass-market of properties that cater for first-time buyers and second-steppers is still seeing high demand and upwards price pressure leading to new record high average prices in those sectors.”

There is no doubt that buyer demand remains strong. And for that reason, the lower end of the market is still booming and Rightmove predict an Autumn Bounce in both prices and seller activity. In contrast to the higher priced property, there are new record price highs in the mass-market sectors made up of two bedroom and fewer first-time-buyer-type properties, up by £1,328 (+0.6%) and three to four bedroom second-stepper-type properties, up by £975 (+0.3%), where activity remains very strong. This is all down to the stock levels being at a record low and buyers having a feeding frenzy on new properties as soon as they hit the market.

The advice from Rightmove, which we echo, is that home owners who have not yet put their property up for sale, and have not yet looked at their own forward housing needs, need to do this as soon as possible. This will enable you to sell at a good price and be in your new home before Christmas.

The average time nationally for a new property listed on the market to sale agreed is 36 days, that is a whole month faster than in February 2020. But with this comes the risk of losing out to another buyer, who will be in a better buying position if your house is not even on the market yet. So having a buyer lined up, subject to contract, before finding your own future home is now the new norm. “Selling before you buy” puts you in the best position so that you are ready to react, as soon as a suitable property comes to market.

Bannister says: “Sell before you buy is a successful tactic in fast moving markets, especially the current one where any new listings popular in both specification and location are selling in days rather than weeks. Your own buyer will have to show a degree of patience while you wait for the right property to come to market, though the pedestrian speed of the normal legal process often creates the opportunity to play catch-up later if it takes a few weeks to find the right property. Some sellers are even completing their sale and going into intermediate rented accommodation and then buying, though this takes extra resolve and time. Having operated in a very fast moving market for over a year now, estate agents know the best tactics to secure the best properties, so it’s well worth sounding them out with a discussion on selling before buying. If you then can’t find anything suitable to buy it’s important to know where you stand on any costs and fees, though agents do report that most who employ this tactic successfully move due to being bolder than some others. We also anticipate that more property will come to market when those owners have more clarity over their employers’ long-term balance of home and office working. Their future housing needs are hard to scope out if it’s still uncertain whether the daily commute is soon going to return. If it’s going to be less restrictive in the long term then that means less need to live close to transport networks, and a greater need for home working space.”