With rumours of property tax changes coming in the next budget, higher-value homes are seeing reduced demand – particularly in London and the South East according to both Rightmove and Zoopla. Find out more about the latest trends nationally and in our regions of Ceredigion, Pembrokeshire and Carmarthenshire with our new house price report.

In Brief

Nationally the market has seen –

- The average price of property coming to the market for sale rises by 0.4% (+£1,517) this month to £370,257.¹

- Average new seller asking prices are now 0.1% below this time last year following several months of muted price growth.¹

- The dip in annual prices is driven by London and the south, as the south underperforms the rest of Great Britain.¹

- However, the number of sales being agreed is 4% ahead of this time last year. In the south of England, it is still up by 3% year-on-year, while it’s up by 5% across the rest of Great Britain.¹

- Zoopla says that pre-Budget tax speculation has hit activity for higher-value homes – demand is down 11% for homes priced at £1m+ and there are fewer new listings over £500,000.²

- It says house price inflation is running at 1.4% to August 2025, with stronger price inflation in more affordable areas – up to +2.8%.²

- Mortgage rates are stable at 4-5%, supporting demand but unlikely to fall in the near term.²

- North/south divide in price inflation and activity widens – weaker southern England and stronger rest of UK.²

- Zoopla adds that market activity is set to plateau in coming weeks, but serious buyers and sellers shouldn’t put decisions on hold.²

In terms of the Welsh property market –

- The average house price in Wales is now £267,528, down 1.2% change over the last month but up 0.9% year on year¹.

- The average number of days for a Welsh property to find a buyer has increased to 72¹.

¹Source – Rightmove

²Source – Zoopla

National Overview

Here is our monthly overview of the trends that Rightmove and Zoopla – two of the biggest names in the property market – have been seeing over the last month.

Rightmove’s Insights –

Rightmove says that they would expect to see a slight increase in new seller asking prices in September, as the return to school boosts activity at the start of autumn. However, it recognises that this year’s 0.4% increase in September is a bit lower than normal – the average for this period is 0.6%.

It says that it is the south of England that is driving the dip, following a summer of competitive pricing by sellers which has driven more sales activity compared to last year. It adds that static house prices, rising wages and lower mortgage rates all assist buyer affordability, and this has led to an increase in the number of sales agreed compared to a year ago.

It also highlights the rumours about property tax changes, which began circulating in mid August, are causing uncertainty. In addition, with the Budget itself not arriving until the end of November, this kind of extended uncertainty can affect the market, especially in the higher price brackets. Movers want to be confident in planning their moving costs.

While Rightmove has not yet noticed any major shifts, it recognises that those who could be negatively affected by the rumoured changes might reassess their short- and medium-term plans. They add that the impact will centre on London and south England, and that these are the areas that are already starting to perform less strongly.

Zoopla’s Insights –

Zoopla also highlights the impact of budget uncertainty on the market. It says that while UK homebuyers have returned to the market in strength over the past two years, speculation about possible tax changes has started to affect activity. Zoopla’s data shows both buyer demand and new listings for homes priced over £500,000 are down compared with a year ago, with some buyers waiting to see what the Autumn Budget will bring.

Zoopla says uncertainty about changes began in August when the media reported on several policy papers. It says that currently one in three homes for sale is priced above £500,000, and 8% are over £1m. But over the past five weeks, buyer demand for £1m+ homes has dropped 11% compared with the same time last year, while demand for properties over £500,000 is down 4%.

Sellers are also sitting tight. There are 9% fewer £1m+ homes and 7% fewer £500,000+ homes coming onto the market. By contrast, demand and supply in the rest of the market are broadly in line with last year, suggesting that speculation about possible Budget changes is mainly affecting higher-value properties. As London and the South East have the largest share of homes priced over £500,000, the impact of this uncertainty is likely to be felt most there in the weeks ahead.

But the market is resilient in more affordable areas, with data showing the lower the average value of homes, the stronger the price increases. Zoopla says markets with average prices below £200,000 are seeing the fastest growth, up 2.8% on average. By contrast, in areas where homes average more than £500,000, prices are barely moving.

Regional Insight from Cardigan Bay Properties

We specialise in the property market in West Wales and monitor developments here throughout the year to give you the best, most accurate advice. We cover the key regions of Ceredigion, Carmarthenshire and Pembrokeshire, and this month Helen Worrall, one of our founders, outlines the key trends we’ve seen through September 2025. If you’d like to find out more please get in touch.

September has been another busy month in West Wales, with our team hosting 48% more viewings than we did during the same period last year. In addition, valuations were up 17% and the number of offers accepted was up 22%. Finally we achieved 22% more new property instructions than in September 2024.

However, we are starting to see signs that things are slowing down a little bit as the market waits to see what the Autumn Budget will bring. We are always working hard to attract interest for our properties, adjusting the online presentation, investing in marketing and contacting our large database of interested buyers. So, if a property has gone quiet on interest, in the current market – with so much choice for buyers – we’d advise sellers to review their price to ensure it sits correctly compared to similar properties.

If your property has slowed up on viewings and/or offers then contact us to discuss your pricing strategy. The next few weeks will see an easing of market demand, until people know what’s coming in the budget, so if you are keen to sell quickly adjustments may be needed to help you stand out in the market.

Your Regional Insights

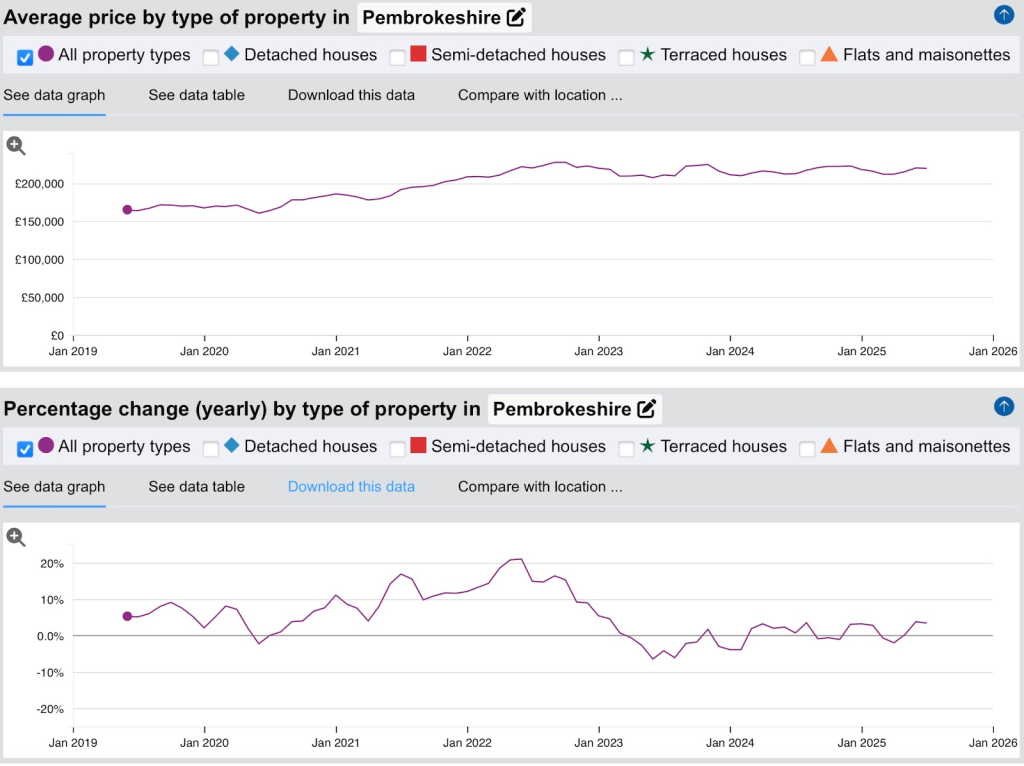

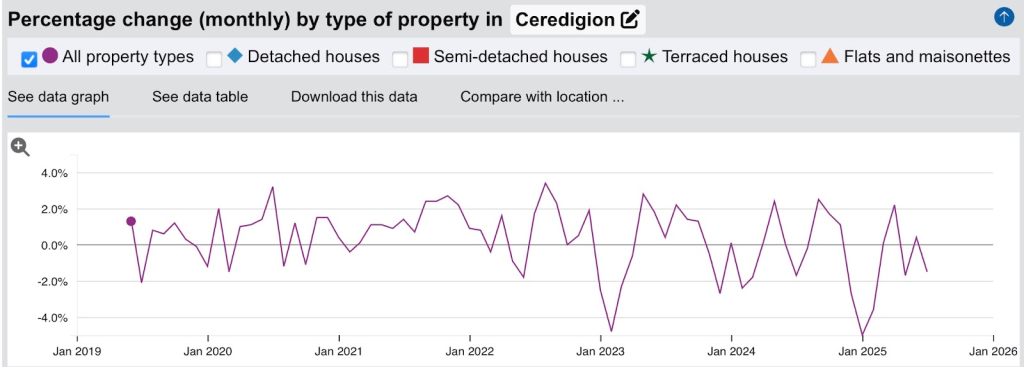

Here we give you an overview of the latest House Price Index results for our key regions – Ceredigion, Pembrokeshire and Carmarthenshire. Please note that each month these figures are two to three months behind due to the Land Registry taking longer to register new sales, so this report includes sales up to the end of July 2025.

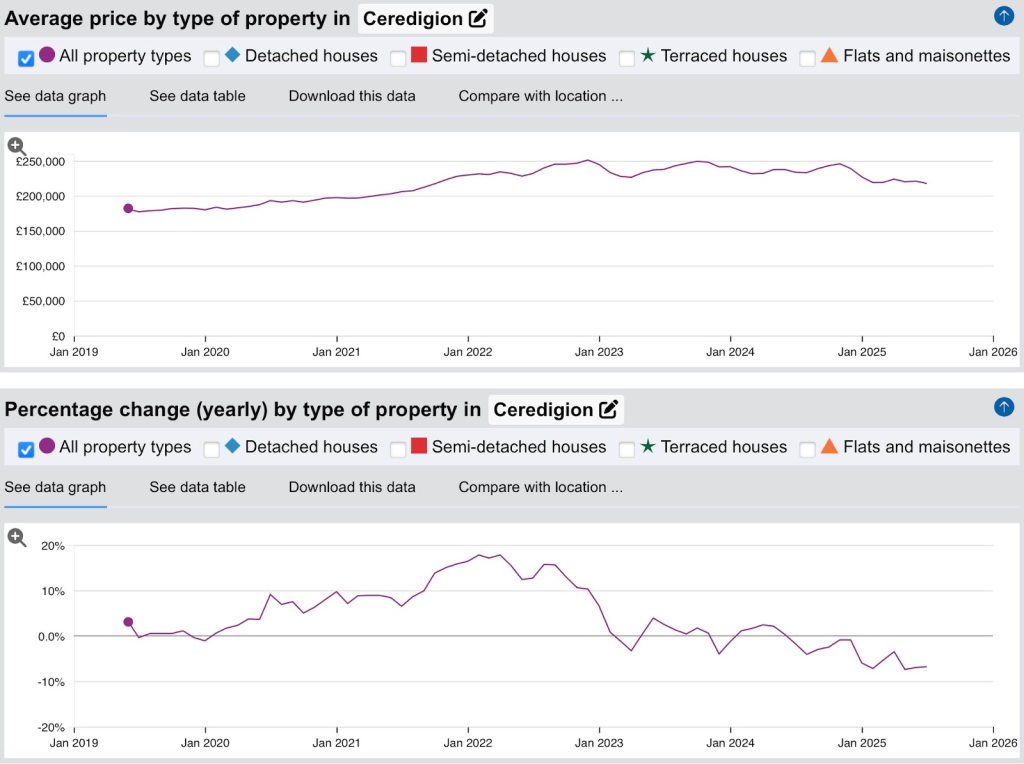

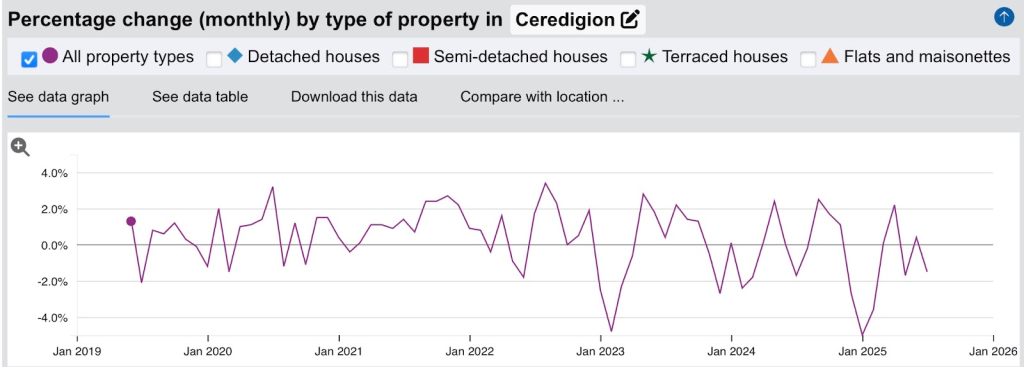

To help you follow the trends for these regions, the graphs below show figures from July 2019 (pre-Covid pandemic) to July 2025.

CEREDIGION

The average property price in Ceredigion fell in July to £217,626 – down from £220,947 in June 2025. The fall is seen across all property types, reflecting the choice of properties on the market and the need for sellers to price competitively to secure a sale. Detached homes dropped from £297,327 to £293,112; semi-detached homes dropped from £188,368 to £184,853; terraced properties dropped from £166,502 to £164,386; and flats dropped from £105,484 to £103,873.

In terms of the annual percentage change in July the average property price fell by 6.8%, with the biggest drops reported for flats – down 10.2% – and terraced properties – down 7.4%. The monthly percentage change also shows a slight drop – down 1.5%, with semi-detached properties showing the biggest drop – down 2.3% from last month’s figure.

View the full Ceredigion report.

PEMBROKESHIRE

In Pembrokeshire the average property price has also dropped slightly – down to £219,685 from £220,309 in June 2025. However, terraced property prices actually rose slightly – up to £168,353 from £168,198 in June. All other property types saw a slight fall in average price.

Looking at the yearly percentage change, prices in Pembrokeshire are up 3.4% over the year, with both detached and semi-detached properties showing a 4% increase and terraced properties showing a 3.2% increase. However, prices of flats dropped by 1.1%.

The monthly percentage change for the region saw a slight drop of 0.3%, with the biggest declines seen for detached properties and semi-detached properties, which fell 0.4% and 0.5% respectively.

View the full Pembrokeshire report.

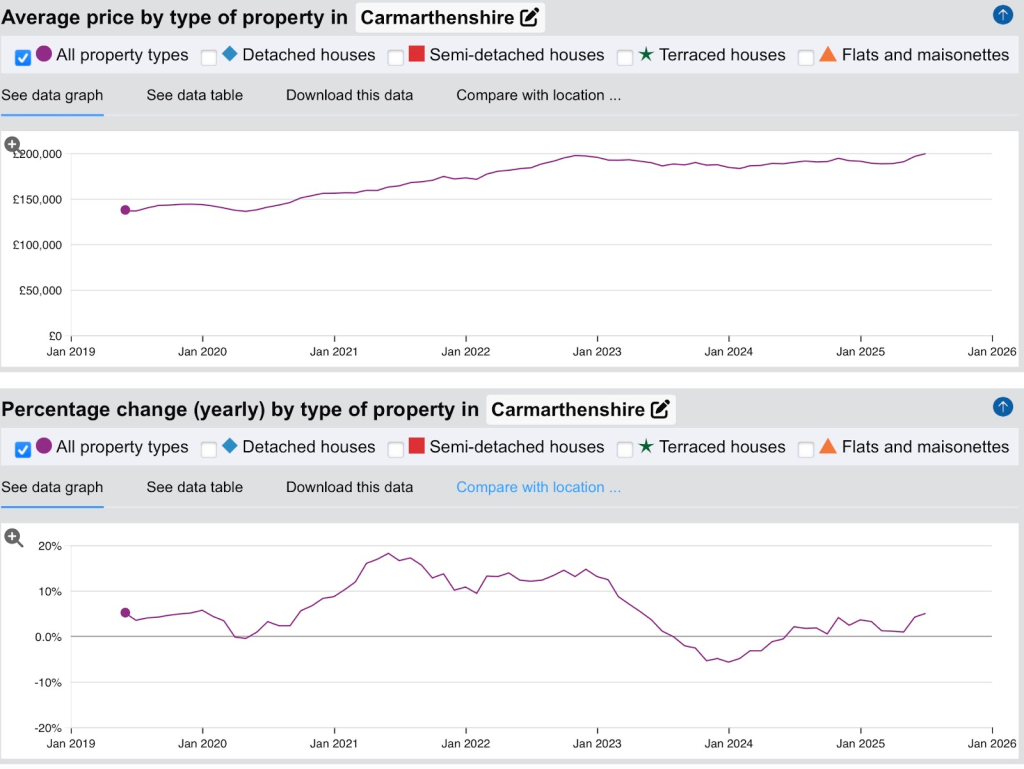

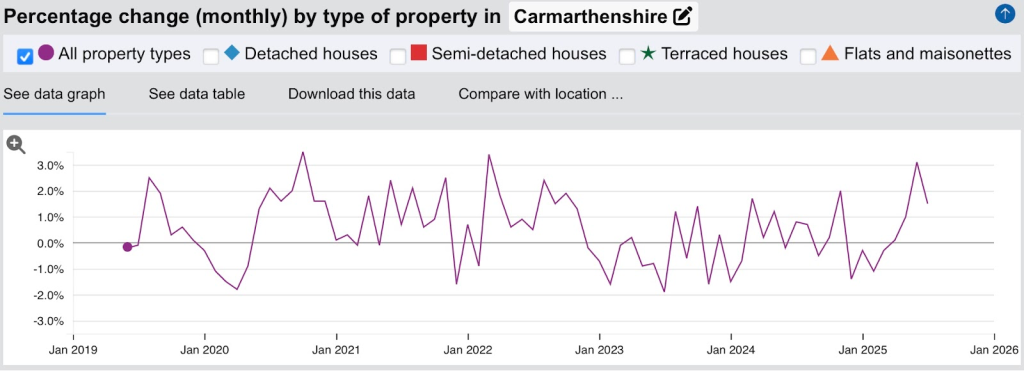

CARMARTHENSHIRE

In Carmarthenshire the average property price has increased this month – it now stands at £199,422, up from £196,456 in June. All of the different property types have seen an increase – detached properties increased to £285,554 (up from £281,453); semi-detached properties increased to £182,820 (up from £180,381); terraced properties increased to £150,374 (up from £147,739) and flats increased to £95,218 (up from £93,881).

The yearly percentage change for the region shows growth of 5%, with the strongest growth for detached and semi-detached properties – both up 5.3%. The monthly percentage change is also up – an increase of 1.5% overall, with the biggest increase reported for terraced properties which were up 1.8% this month.

View the full Carmarthenshire report.

CURRENT UK HOUSE PRICE INDEX

* As of July 2025, the average house price in the UK is £269,735, and the index stands at 103.4. Property prices have risen by 0.3% compared to the previous month, and risen by 2.8% compared to the previous year.

*Details provided by the Land Registry. For more information on the House Price Index please CLICK HERE

Please note that the stats provided by the UK House Price Index are live and constantly evolving.