With reports that sales activity in the housing market is at its highest level since 2020, there’s a lot to think about if you’re buying or selling a home. Here we help by giving you an overview of the latest trends from Rightmove and Zoopla, as well as our own regional insights into the property market in West Wales.

In Brief

Nationally the market has seen –

- Average new seller asking prices rose by just 0.3% (+£1,199) to £371,958 – much lower than the average seasonal 1.3% monthly increase at this time of year¹.

- Market activity remains strong, but the muted Autumn price increase comes as buyer choice and seller competition rise¹.

- The number of sales being agreed is up by 29% year-on-year, a strong rebound from the weaker market a year ago¹.

- The number of available homes for sale is 12% higher than a year ago¹.

- UK house price inflation increases to +1%, up from -0.9% a year ago².

- Sales activity is running at the highest level since the 2020 boom².

- Pipeline of sales agreed is 30% higher than a year ago, at £113bn².

- First-time buyers are the largest buyer group in 2024 (making up 36% of sales)².

- The high supply of homes for sale and affordability pressures are keeping house price inflation in check².

In terms of the Welsh property market –

- The average house price in Wales is now £263,212, down 0.8% over the last month, but up 1.8% year on year¹.

- The average number of days for a Welsh property to be on the market before a sale is agreed has increased to 69¹.

¹Source – Rightmove

²Source – Zoopla

National Overview

According to Rightmove the latest snapshot of sales activity in the UK housing market is 29% ahead of the same period last year, and it is reporting a healthy level of underlying buyer demand as people plan their next move. It says that the number of people contacting agents about homes for sale is up 17% compared with this time last year.

It also highlights that it is very much a buyers market, with buyer choice soaring to a level not seen since 2014. The average price of property coming to the market for sale rose slightly – up 0.3% (+£1,199) to £371,958 – a much lower monthly increase in new seller asking prices than is typical at this time of year. The long-term average October rise is +1.3%.

With more properties on the market, buyers are able to shop around and have greater negotiating power, ensuring that price increases have been subdued. To secure a quick sale, sellers need to price competitively, particularly with affordability stretched for many.

Zoopla too is reporting that 2024 is turning into a bumper year for housing sales. It says that competition among lenders has seen average mortgage rates reach their lowest level for two years, helping support the highest level of new sales agreed since 2020’s boom in the wake of pandemic restrictions being lifted.

Zoopla is also seeing that house price increases are subdued, up by just 1% over the last 12 months to September 2024, compared to -0.9% a year ago. It says that price inflation is being held back due to the large choice of homes coming onto the market, as well as affordability pressures holding back buying power.

Regional Insight from Cardigan Bay Properties

If you’re thinking about buying or selling a property in West Wales then we’re here to help. Each month we bring you the latest insights on the national property market and how it is evolving, looking at two of the biggest names – Rightmove and Zoopla.

To support this, we also provide our own regional overview, based on what we have seen over the last month in our key regions of Ceredigion, Carmarthenshire and Pembrokeshire.

This year has had its ups and downs in terms of the housing market. High interest rates, the general election, budgets, and more have all impacted performance, but with the interest rate cut this week and more certainty in the market, it is looking like a promising winter for both sellers and buyers.

Overall we are definitely seeing that confidence is returning to the market – first-time buyer chains are building and a growing number of offers are coming in. It’s also worth noting that while historically home buying used to be seasonal, this has changed over the years and homes are now selling well throughout the year – including the winter period.

Reflecting this, October has ended as a very busy month. While the number of sales agreed in October 2024 is the same as for October 2023, we’ve seen a much higher number of viewings. This October we had 141 viewings, compared to 105 viewings in the same month last year, setting the pace for a busy November.

We’ve also had a high number of offers being made, and while they have been lower than the asking prices in most cases, this reflects the national trend of subdued pricing in a buyers market.

Your Regional Insights

Here we give you an overview of the latest House Price Index results for our key regions – Ceredigion, Pembrokeshire and Carmarthenshire. Please note, that each month these figures are two to three months behind due to the Land Registry taking longer to register new sales, so this report includes sales up to the end of August 2024.

To help you follow the trends for these regions, the graphs below show figures from July 2019 (pre-Covid pandemic) to August 2024.

CEREDIGION

August 2024 saw a drop in the overall average house price in Ceredigion – down to £245,655, from July’s figure of £247,509. The fall in prices was seen across all property types, except for flats which saw a very slight increase – up from £120,167 to £120,291.

In terms of the yearly percentage change, the August figure was down 1.4% – compared to July which was up 1.5%, reflecting the subdued pricing reported by Zoopla and Rightmove. The largest % fall was seen by detached properties – down 2.9% – and flats, which were down 1.3%.

The monthly percentage change also fell slightly – by 0.7% overall, with detached houses down 1.2%, semi-detached houses down 0.6%, terraced houses down 0.1% and flats showing a slight increase on the previous month – up 0.10%.

View the full Ceredigion report.

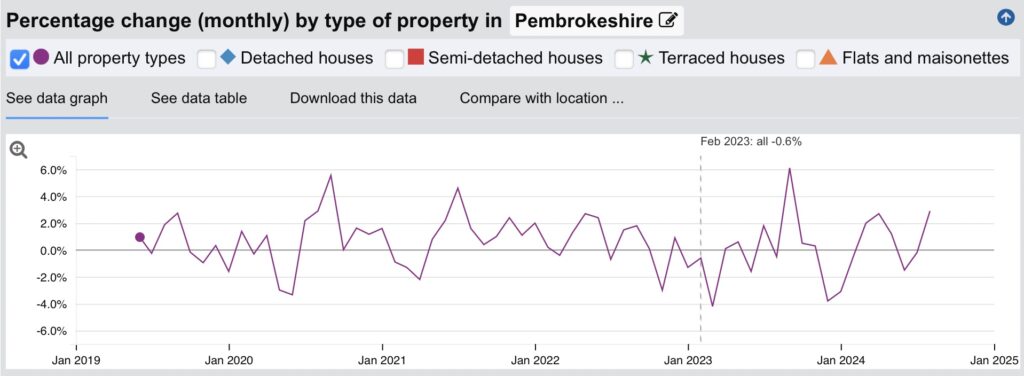

PEMBROKESHIRE

In Pembrokeshire the housing market has seen further strong price growth. Overall the average property price in August increased to £237,801 – from £231,044 in July 2024. Detached properties increased from £316,679 in July to £323,867 in August; semi-detached from £206,046 to £212,333; terraced properties from £175,168 to £181,488; and flats from £116,614 to £120,821.

In terms of the yearly percentage change, overall this increased by 6.5% in August, with the largest growth being seen for semi-detached properties – this sector saw an increase of 8.3% in August, followed by terraced houses – up 7.5%.

The monthly percentage change also increased – up 2.9% overall in August. The strongest increase was seen for terraced houses and flats – both up 3.6% this month.

View the full Pembrokeshire report.

CARMARTHENSHIRE

August 2024 saw the average house price in Carmarthenshire fall slightly from £198,232 in July to £196,536. This drop is seen across all different property types – detached properties fell from £264,223 to £260,122; semi-detached properties fell from £175,800 to £174,526; terraced houses fell from £144,813 to £144,490; and flats fell from £116,695 to £116,438.

The yearly percentage change also shows a drop – overall down 2.2% in August 2024, following a 0.2% drop in July. This is reflected across all property types, with the biggest drop for detached properties – down 3.9% – and flats, which fell by 2.6%. This is supported by the monthly percentage change – overall August 2024 was down 0.9%, following a 1.8% drop in July 2024 – with the biggest drop among detached properties, which fell by 1.6% in August.

View the full Carmarthenshire report.

CURRENT UK HOUSE PRICE INDEX

* As of August 2024, the average house price in the UK is £292,924, and the index stands at 153.6. Property prices have risen by 1.5% compared to the previous month, and risen by 2.8% compared to the previous year.

*Details provided by the Land Registry. For more information on the House Price Index please CLICK HERE

Please note that the stats provided by the UK House Price Index are live and constantly evolving.