The last month saw Budget jitters impacting the market – particularly the top end of the market where rumours of new property taxes slowed demand. Read more about the latest property market trends nationally and in our regions of Ceredigion, Pembrokeshire and Carmarthenshire with our new house price report.

In Brief

Nationally the market has seen –

- Average new seller asking prices fell by 1.8% (-£6,589) this month to £364,833. This is a larger-than-usual November drop, as the decade-high number of homes for sale and Budget hiatus add to the seasonal slowdown in new seller pricing.¹

- Asking price reductions of homes already on the market are at their highest level since February 2024, as sellers try to tempt bargain-hunting buyers.¹

- Speculation about the Budget fuelled uncertainty across much of the market, especially at the upper end where there were rumours of property tax increases:

- Sales agreed for £2 million+ homes are down 13% year-on-year.¹

- Homes priced between £500,000 and £2 million saw sales agreed drop by 8% year-on-year.¹

- The under £500,000 market has been less impacted, with sales agreed down by only 4% on this time last year – likely unsettled by general Budget jitters rather than specific policy rumours.¹

- Despite these downward trends across the month of October, the year to date still shows the number of sales being agreed at 4% above the same period in 2024.¹

- The average two-year fixed mortgage rate is 4.41%, compared to 5.06% at this time last year.¹

- According to Zoopla, house prices in southern England have dipped for the first time in 18 months².

- BUT, it says prices elsewhere are still rising by up to 3%, helped by a steady supply and better affordability².

- Buyer demand down 12% with sales agreed 4% lower².

- Post-Budget relief for 210,000 sellers – as the threat of an annual property tax on homes over £500,000 is lifted and expected to boost market activity at the start of 2026².

- With no major tax changes, the market now has a clearer outlook, which should support activity in early 2026².

- Zoopla adds that with Stamp Duty unchanged, more buyers are nudged into higher tax bands, weighing on prices and making moving home less tempting².

In terms of the Welsh property market –

- The average house price in Wales is now £261,305, down 2.4% over the last month, but up 0.5% year on year¹.

- The average number of days for a Welsh property to find a buyer has fallen to 71¹.

¹Source – Rightmove

²Source – Zoopla

National Overview

Here is our monthly overview of the trends that Rightmove and Zoopla – two of the biggest names in the property market – have been seeing over the last month.

Rightmove’s Insights –

Rightmove reports that the decade-high number of homes for sale continues to limit price increases. It says that many new sellers want to avoid over-pricing compared to the competition.

The Budget has been the main distraction it says, with many waiting to see what impact Government policy will have on their finances. With the Budget coming later in the year than usual, the normal lull in sales seen around Christmas arrived early. As a result, sellers who are keen to move are having to work harder with competitive pricing in order to attract buyers.

This means that average new seller asking prices are now 0.5% cheaper than a year ago, while one third of homes already on the market have had their asking price reduced by an average of 7%.

It says that the upper end of the market has experienced more hesitation in sales activity due to the rumours around the Budget. Added to this was a general unease about how the Budget might impact personal finances. However, it highlights that falling mortgage rates and rising wages have boosted affordability, but it stresses that the market needs further Bank Rate cuts.

Zoopla’s Insights –

Zoopla highlights that market activity – particularly in southern England – has cooled slightly since the summer due to speculation about the Budget. However, in other areas it says momentum has remained strong, with prices rising by 2-3% across Wales, northern England and Scotland.

It also says that the rumours of new taxes on homes over £500,000 had a greater impact in the south, where over a third of properties for sale fall into this bracket. This, along with wider market trends, has nudged prices lower and supported the current buyers’ market.

Elsewhere in the UK uncertainty around the Budget had less impact. Zoopla says that more accessible prices, improved affordability and stable or reduced stock levels are supporting price growth.

Like Rightmove, Zoopla says that the seasonal slowdown arrived early this year, with buyer demand 12% lower than last autumn. But it believes the market is proving resilient with sales only 4% lower than a year ago as buyers look to secure a deal before the end of the year.

It adds that overall the Zoopla UK House Price Index shows average prices are 1.3% higher than a year ago, which is similar to last month – and only a little behind the 1.7% annual growth of last year.

And since the Budget announcement it says that there is relief for 210,000 sellers – as the threat of an annual property tax on homes over £500,000 is lifted, which should boost market activity at the start of 2026.

Regional Insight from Cardigan Bay Properties

We specialise in the property market in West Wales and monitor developments here throughout the year to give you the best, most accurate advice. We cover the key regions of Ceredigion, Carmarthenshire and Pembrokeshire, and this month Helen Worrall, one of our founders, outlines the key trends we’ve seen through October 2025. If you’d like to find out more please get in touch.

According to our latest agents report from Zoopla, property prices in our areas have increased by 2.1% over the last year and 4.6% over the last three years. This compares to the national average of 1.3% up over the last year and 2% up over the last three years, underlining the demand we’re seeing in West Wales.

In terms of the figures for our regions through October, they reflect the overall picture of caution ahead of the Budget. Valuations were down by 19% compared to 2024 levels for October, while the number of viewings through the month fell by 22% as potential buyers chose to hold off until their financial outlook was more certain.

However, what we did see was a 50% increase in the number of offers accepted in October 2025 compared to the same month in 2024 as sellers were keen to secure a sale ahead of the Budget and the pre-Christmas lull.

The quieter market continued into November, but following the Budget announcement, which did not bring the feared tax burden for many people, we’re expecting to see the normal Boxing Day Bounce once the Christmas rush has died down. This Boxing Day Bounce sees property search activity spike, with many people using the festive period to reflect and reassess their situations. As a result, property browsing soars and buyers are motivated and keen to move quickly in the New Year.

Your Regional Insights

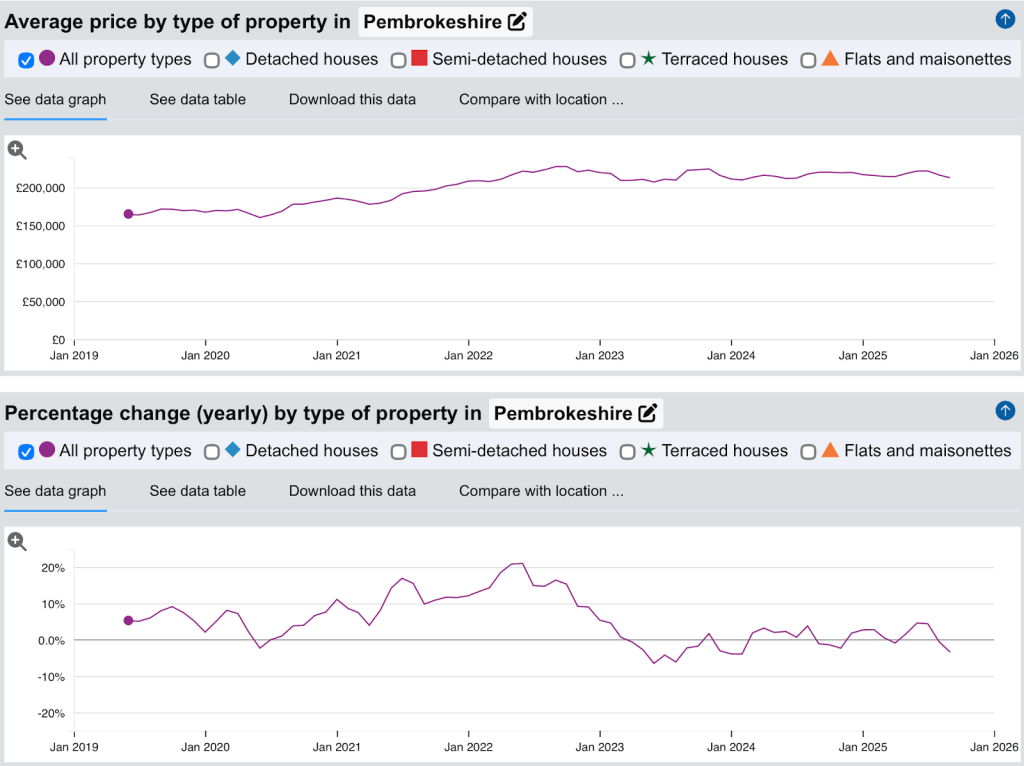

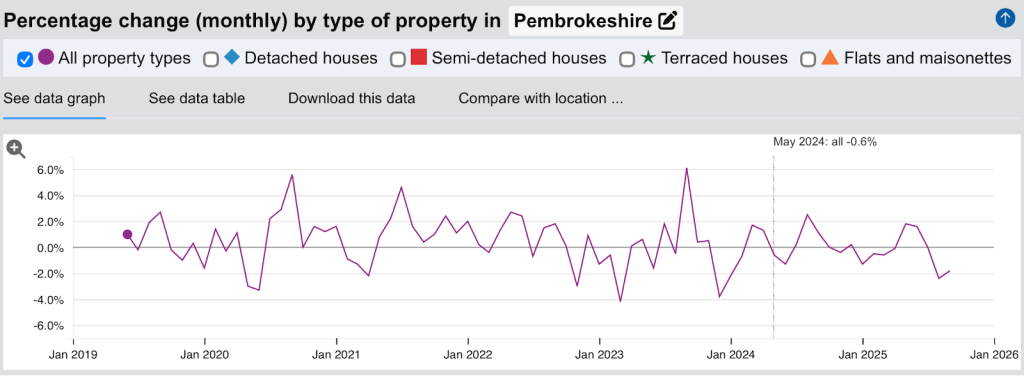

Here we give you an overview of the latest House Price Index results for our key regions – Ceredigion, Pembrokeshire and Carmarthenshire. Please note that each month these figures are two to three months behind due to the Land Registry taking longer to register new sales, so this report includes sales up to the end of September 2025.

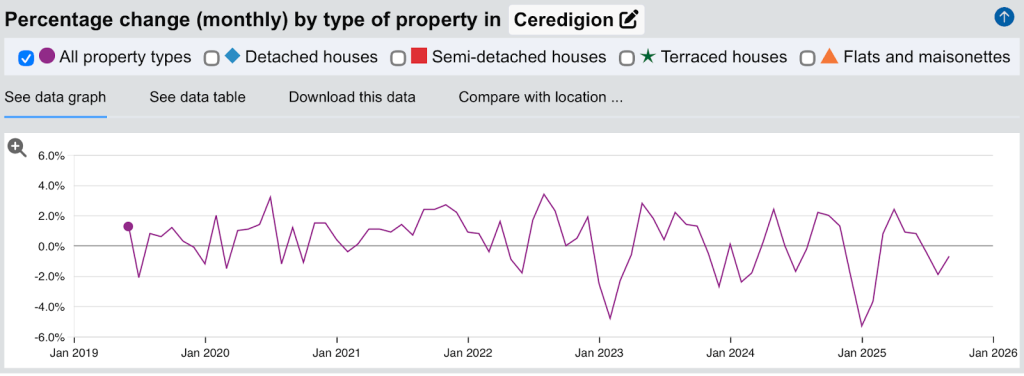

To help you follow the trends for these regions, the graphs below show figures from July 2019 (pre-Covid pandemic) to September 2025.

CEREDIGION

In Ceredigion over the last month the average property price fell to £223,907 in September 2025 – down from £225,536 in August. All property types – detached, semi-detached, terraced and flats – saw a slight fall in their average price over the month as demand slowed due to a combination of factors, including nervousness around the November Budget.

In terms of the yearly percentage change, the average price fell by 6%, with the biggest drop seen for flats, which fell by 8.9%. This was followed by detached properties (down 6.3%); terraced properties (down 6.2%) and semi-detached properties (down 4.9%).

The monthly percentage change saw a much smaller drop – down just 0.7% on average, with the biggest monthly fall seen for flats – down 0.9%.

View the full Ceredigion report.

PEMBROKESHIRE

In Pembrokeshire it’s a similar picture, with the average property price falling to £212,859 (down from £216,680 in August). Again, this drop is seen across property types – detached properties fell to £308,288 (down from £313,787 last month); semi-detached properties fell to £195,195 (down from £198,341); terraced properties fell to £163,071 (down from £166,251); and flats fell to £113,650 (down from £115,952).

The yearly percentage change for the region fell by 3.4%, with the biggest drop for flats (down 7.1%), while semi-detached properties saw the smallest change (down 1.7%). The monthly percentage change also showed a slight drop of 1.8% overall.

View the full Pembrokeshire report.

CARMARTHENSHIRE

This month Carmarthenshire is bucking the trend, with the average property price actually increasing slightly – up to £199,590 from £198,565 in August. The other good news is that all property types have experienced a small increase in their average asking price.

Looking at the yearly percentage change, property prices in the region are up 5% overall, with the biggest increase seen for semi-detached properties which are up 6.1% over the year. This is followed by terraced properties (up 4.8%); detached properties (up 4.4%) and flats (up 0.3%). The monthly percentage change is also up slightly – up 0.5% – with the biggest increase again seen for semi-detached properties, which were up 0.6%.

View the full Carmarthenshire report.

CURRENT UK HOUSE PRICE INDEX

* As of September 2025, the average house price in the UK is £271,531, and the index stands at 104.1.Property prices have fallen by 0.6% compared to the previous month, and risen by 2.6% compared to the previous year.

*Details provided by the Land Registry. For more information on the House Price Index please CLICK HERE

Please note that the stats provided by the UK House Price Index are live and constantly evolving.