Find out More… MARCH 2024 HOUSE PRICE INDEX

Spring Boosts Buyer Demand

The March 2024 House Price Index is out and is showing positive signs in terms of buyer demand and sales activity, but with mortgage rates still raised the housing market remains price sensitive as we head into the spring selling period.

In Brief

Nationally the market has seen –

- A 13% increase in the number of sales agreed compared to the same period last year.¹

- Buyer demand up 8% year on year – led by the larger home sector, which is less sensitive to mortgage rates, and London.¹

- The average asking price is £4,776 below the May 2023 peak.¹

- Annual house price inflation remains negative at -0.3%.²

- The percentage of the asking price achieved has narrowed from 95.5% in November 2023 to 96.1% in March 2024.³

In terms of the Welsh property market –

- It takes – on average – 82 days for a seller to find a buyer in Wales

- House prices in mid-Wales have increased by 1.2% over the last month, and are up 1% year on year

¹Source – Rightmove

²Source – Zoopla

Overview

The overall performance of the housing market continues to be more positive than in 2023, with both prices and buyer demand rising. Spring is known as a strong selling period, and with the increase in buyer demand and sales reported over the last few months, there is growing confidence among sellers that higher prices can be achieved.

However, the much anticipated Chancellor’s spring budget offered little to impact the market – in particular, there was no direct help to support first-time buyers – and time will tell if some sellers are being over-optimistic, even with the spring selling period in full swing.

Mortgage rates continue to dampen certain sectors of the market. The average five-year mortgage rate is now at 4.84%, compared to 4,64% five weeks ago, and while this has less impact on the larger home sector, for the first-time buyers that help drive the property market it continues to hold back sales.

If time is a key factor for you, then it’s worth noting that properties that are competitively priced are selling quickly, with buyers monitoring the market to find quality properties in their preferred locations. Properties priced at the top end of the market, hoping to achieve the full asking price, are taking longer to sell or are dropping their price to secure a sale.

Insight from Cardigan Bay Properties

Each month we monitor the trends taking place in the property market to help owners decide on the best course of action for their situation – from deciding when to sell to making price adjustments if needed. And because we specialise in West Wales, we understand the individual elements that drive the property market in this rural area.

The start of spring has brought strong buyer interest, with more properties coming onto the market and nine property sales agreed through March. This comes off the back of a strong February where we agreed eight property sales in what is traditionally a quiet month.

The sales we’ve seen over the first quarter of 2024 are for a mix of properties. January sales were at the lower end of the market, February at the top end, and March sales were for a mix of price ranges, but with most for properties over £300,000.

While mortgage rates continue to be higher than the market has been used to, there is some stabilisation and overall we’re seeing more confidence coming into the market – from both buyers and sellers.

Your Regional Insights

Here we bring you an overview of the latest house price index results for our key regions – Ceredigion, Pembrokeshire and Carmarthenshire. Each month these figures are two to three months behind, due to the Land Registry taking longer to register new sales, so this report includes sales up to the end of January 2024.

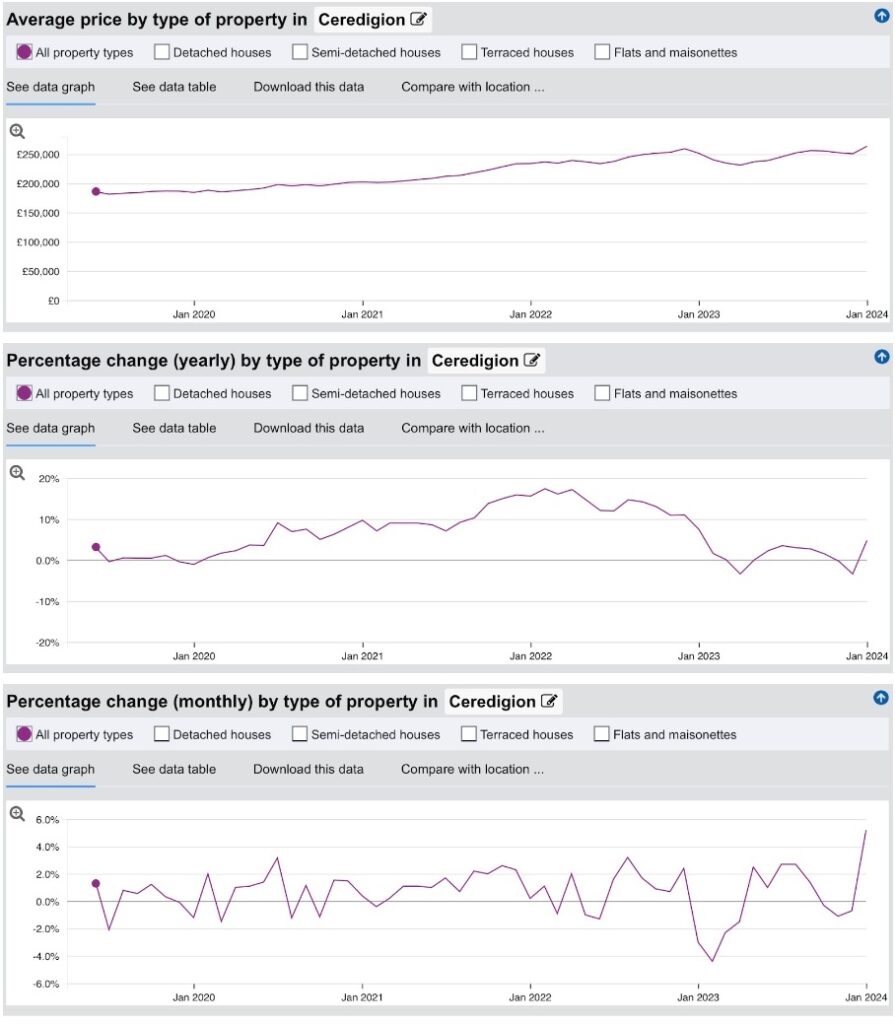

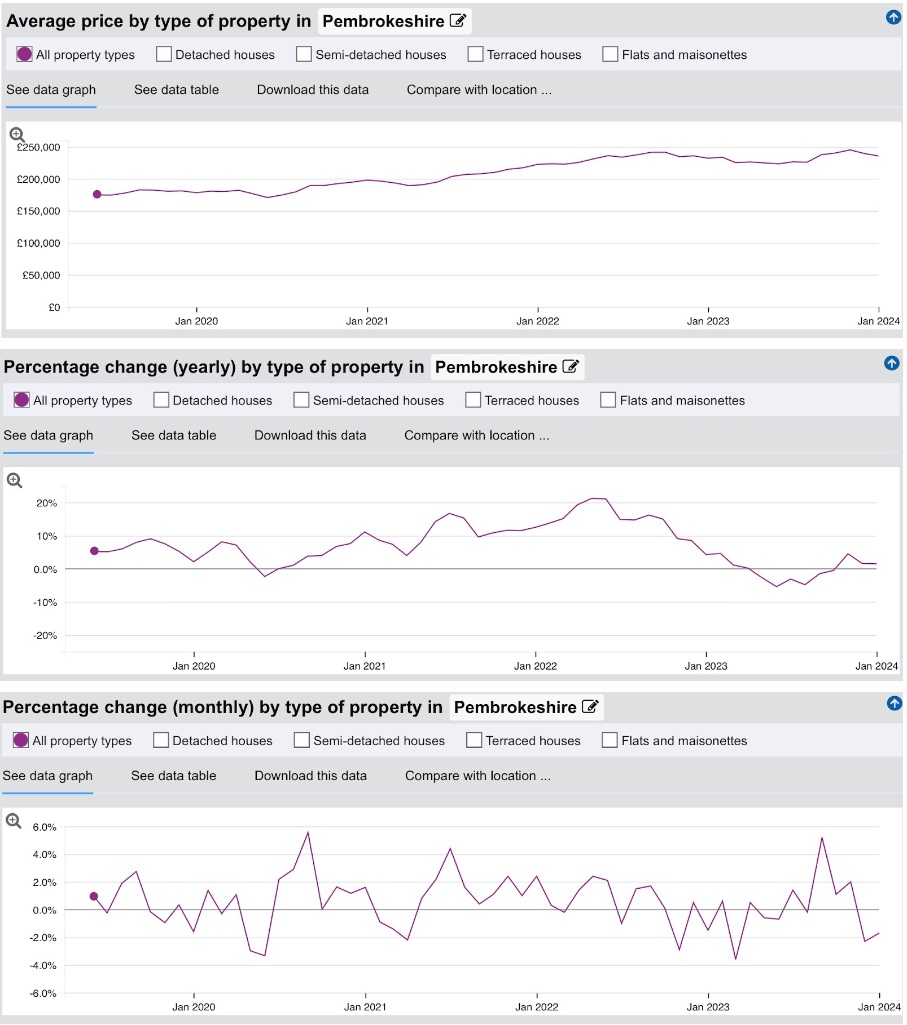

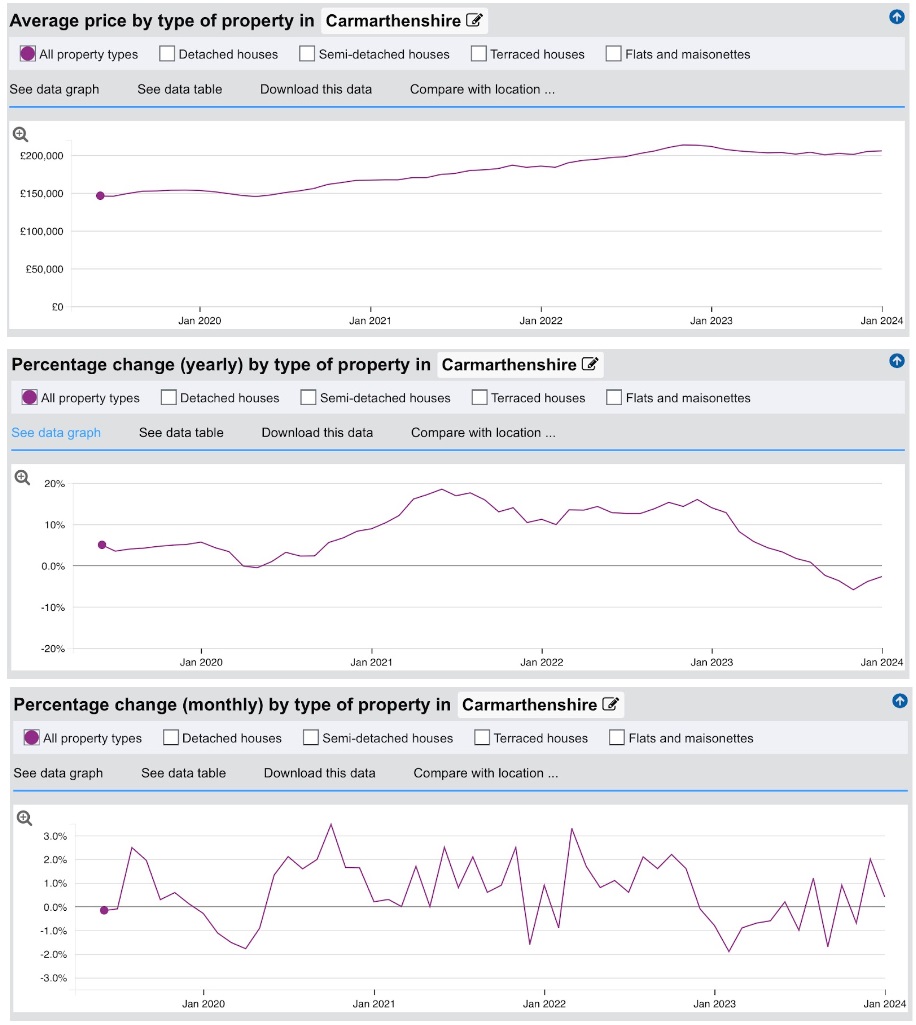

To help you follow the trends for these regions, the graphs below show figures from July 2019 (pre-Covid pandemic) to January 2024

CEREDIGION

January 2024 saw strong price increases across the board for properties in Ceredigion, boosted by the positivity of the spring housing market. The average property price in the area is now £263,706, up from £250,771 in December 2023, with detached houses now averaging £336,517; semi-detached averaging £222,904; terraced houses averaging £192,923; and flats averaging £126,831.

The yearly percentage change for properties in the region saw an increase of 4.8%, a big jump following last month’s drop of -3.4%, and another sign that confidence is returning to the market. Similarly, the average monthly change for the region is up 5.2% – the biggest monthly increase over the period of July 2019 to January 2024. Interestingly it’s semi-detached houses which have seen the biggest price increase – annually up 6.1% and monthly up 5.4%.

View the full Ceredigion report.

PEMBROKESHIRE

In Pembrokeshire the House Price Index Report shows a drop in the average house price – down to £235,578 in January 2024, from £239,584 in December 2023. All house types – detached, semi-detached, terraced and flats – have seen some level of decline.

In terms of the yearly change, prices are actually up slightly with a 1.5% increase year on year – the biggest annual growth is for semi-detached properties, which have seen a 2.6% price increase. The story is slightly different for the monthly percentage change, which shows a drop of 1.7% overall.

View the full Pembrokeshire report.

CARMARTHENSHIRE

January 2024 showed a slight increase in the average property price in Carmarthenshire. This month it reached £205,588 – compared to £204,793 in December 2023 – with all property types reflecting this growth pattern.

The yearly percentage change for Carmarthenshire is down 2.7% – less than the 3.9% drop shown in December 2023. The biggest price drop was in the flat/maisonette sector (down 3.5%), while semi-detached property prices held up slightly better with a fall of 2.10%.

Comparing monthly price changes, January 2024 showed a 0.4% increase, again with the semi-detached sector performing slightly better with an increase of 0.5% – recognition of the demand for these middle market properties.

View the full Carmarthenshire report.

CURRENT UK HOUSE PRICE INDEX

* As of January 2024, the average house price in the UK is £281,913 and the index stands at 147.9. Property prices have risen by 0.5% compared to the previous month, and fallen by 0.6% compared to the previous year.

*Details provided by the Land Registry. For more information on the House Price Index please CLICK HERE